STATS 509 - Statistical Models and Methods for Financial Data (In progress)

This page contains my course work from STATS 509 (Winter 2023)

- Programming language: R

- Topics:

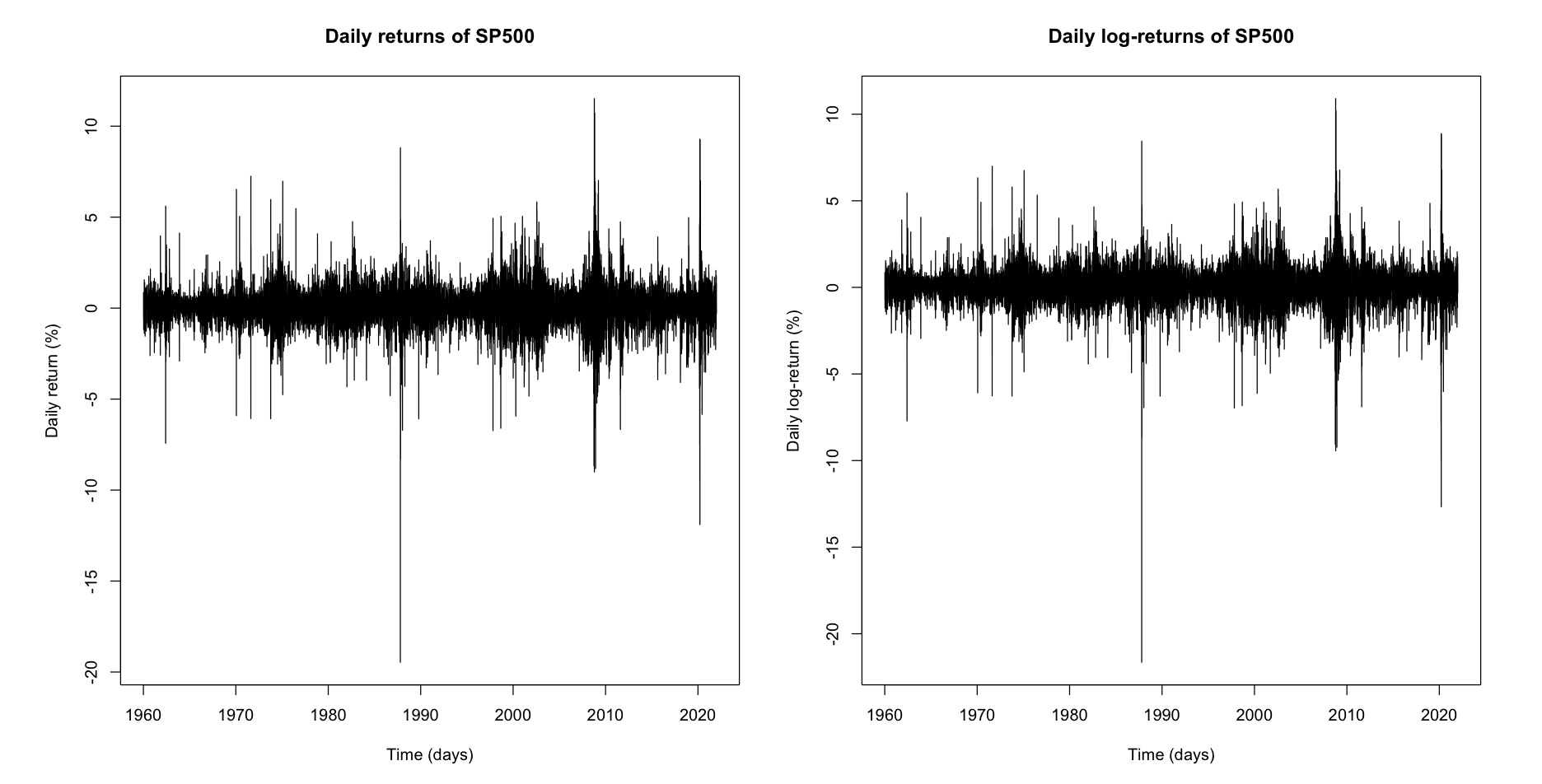

- EDA(Exploratory Data Analysis): Boxplots, Histogram, KDE(Kernel Density Estimation), QQ plot, TKDE(Transformation Kernel Density Estimation)

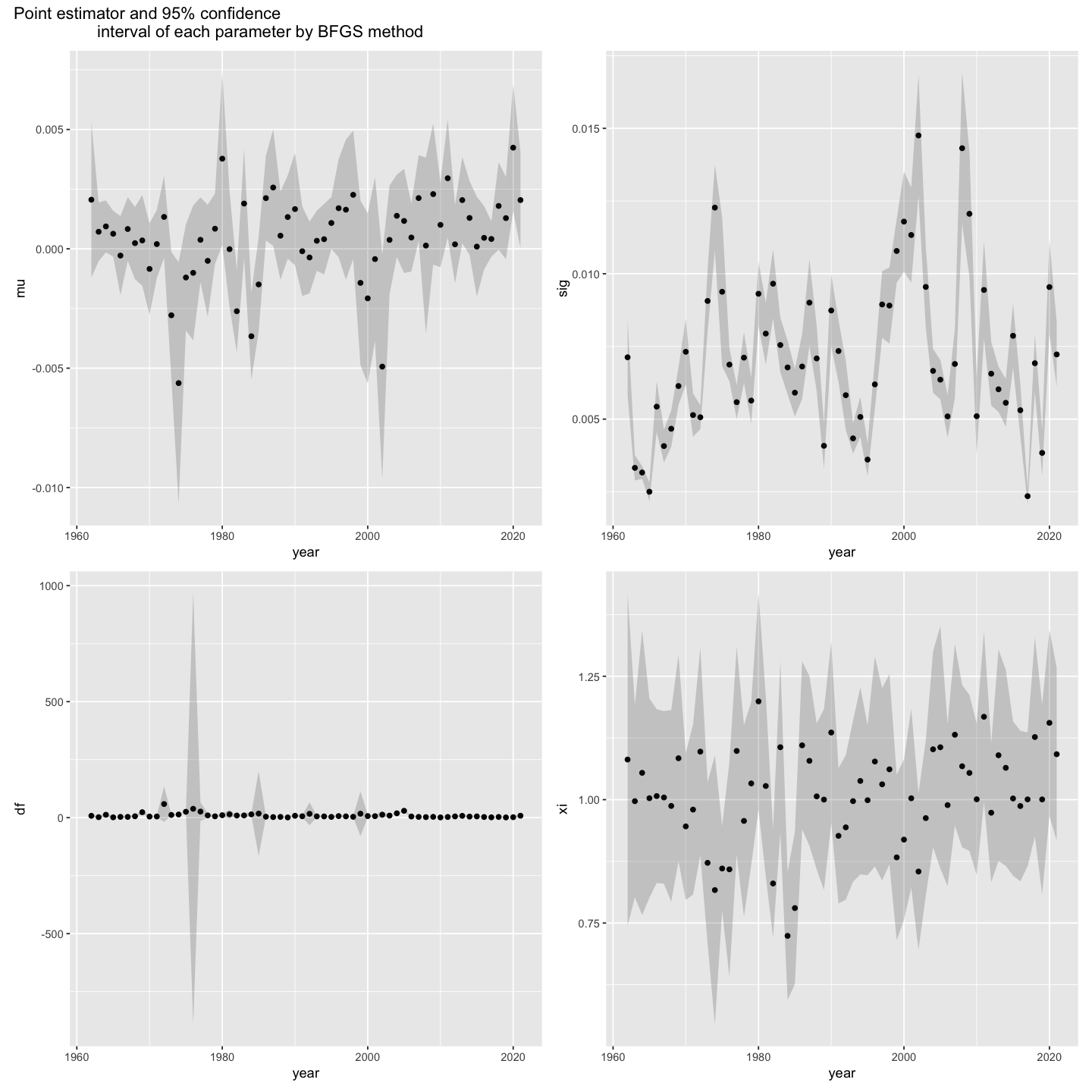

- Modeling univariate distribution: Location, scale, and shape families, Skewness and kurtosis, MLE(Maximum Likelihood Estimation), Goodness-of-fit tests, Tail inference

- Multivariate modeling: Multivariate Normal and t-distribution, Regression, Copula

- Time series: ARIMA(Autoregressive Integrated Moving Average) model, Model selection and forecasting

- Portfolio theory: Markowitz variance-optimal portfolios, CAPM, Fama-French factor model

- Non-linear time series: ARCH, GARCH, ARMA-GARCH

- Risk quantification: Measure of risk, Estimation of VaR and Expected Shortfall, Resampling and backtesting

Study

- Modeling univariate distribution

- Modeling extremes

- Bootstrap